With Bitcoin that seems more bullish, the inevitable question arises on how high BTC could realistically go to this market cycle? Here we will explore a wide range of chain evaluation models and cycle timing tools to identify plausible price objectives for a peak of bitcoin. Although the forecast is never a substitute for the disciplined data reaction, this analysis provides us with framework to better understand where we are and where we could go.

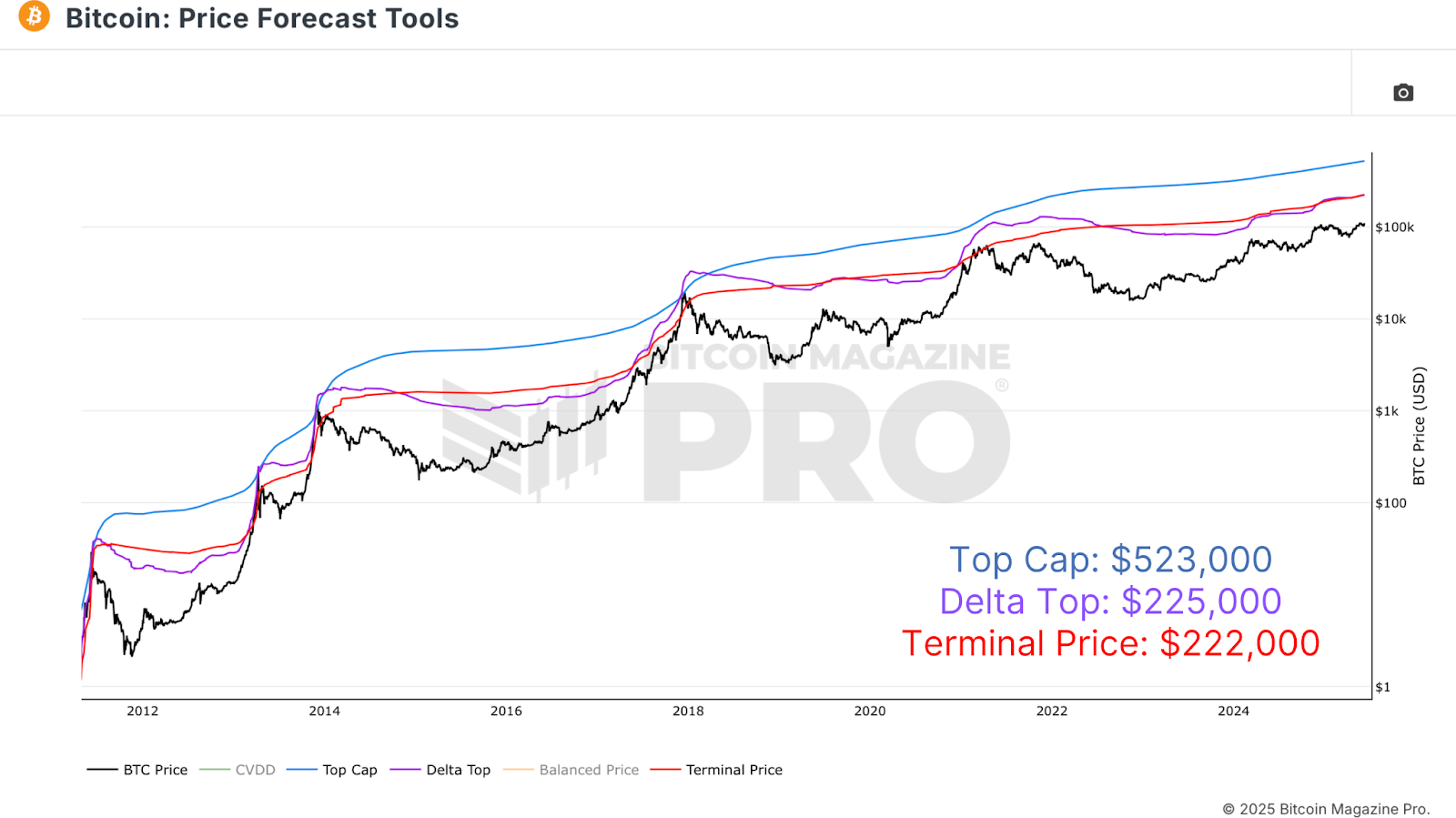

Price forecast tools

The journey begins with the free prices of the free prices of the Bitcoin Pro magazine, which fill in different models of historically accurate evaluation. Although it is increasingly effective to react to data rather than blindly providing prices, the study of these metrics can still provide a powerful context for market behavior. If the macro, derivatives and chain data begin all the alerts of flashing, it is usually a solid moment to obtain profits, regardless of the fact that a specific price objective has been achieved. However, exploring these evaluation tools is informative and can guide the strategic decision -making process if used together with a wider market analysis.

Among the key models, the upper limit multiplies the average limit of 35 for the peak evaluations of the project. He carefully foreseen the top of 2017, but lost his 2020-2021 cycle, estimating over $ 200,000 while Bitcoin reached the peak of about $ 69k. Now it is aimed at over $ 500,000, which seems increasingly unrealistic. A further step forward is the top delta, subtracting the average limit from the limit made, based on the basis of the cost of the whole circulating BTC, to generate a more founded projection. This model suggested a last $ 80k – $ 100k cycle. The most consistently accurate, however, is the terminal price, based on the days of coins suitable for the destroyed offer, which have strictly aligned with each previous peak, including the $ 64k top in 2021. Currently projecting about $ 221k, it could switch to $ 250k or more, and probably remains the most credible model to predict the macro -macro macro. Of course, more information about all these metrics and their calculation logic can be found under the graphs of the site.

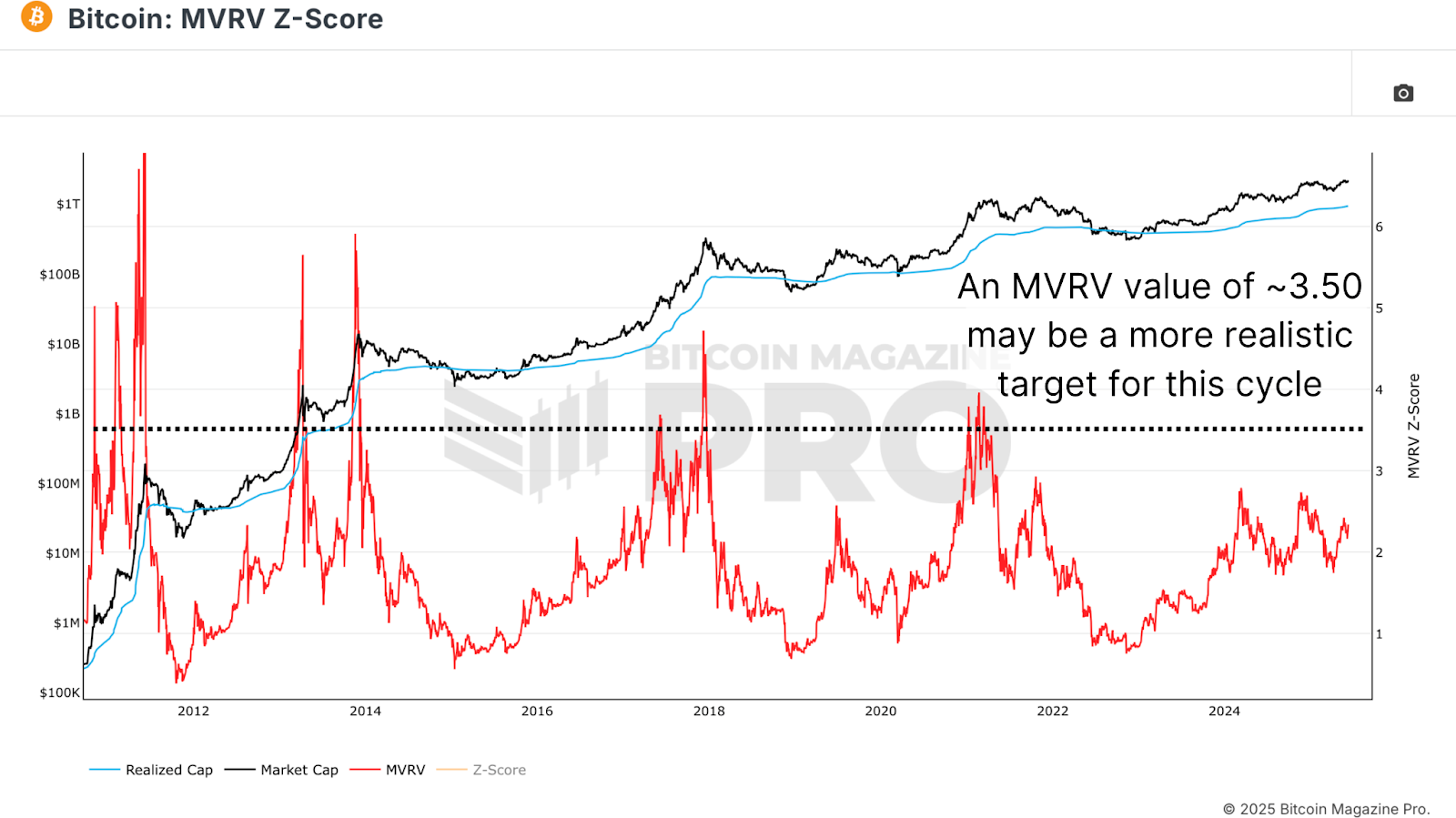

Peak forecast

Another powerful metric is the MVRV relationship, which compares market capitalization with the limit made. It offers a psychological window on the feeling of investors, generally reaching a peak close to a value of 4 in the main cycles. The ratio is currently at 2.34, suggesting that there may still be space for a significant rise. Historically, since MVRV approaches 3.5 to 4, long -term owners begin to create substantial earnings, often report the maturity of the cycle. However, with decreasing returns, this time we may not reach a full 4. Instead, using a more conservative estimate of 3.5, we can start projecting more rooted peak values.

Calculation of a target

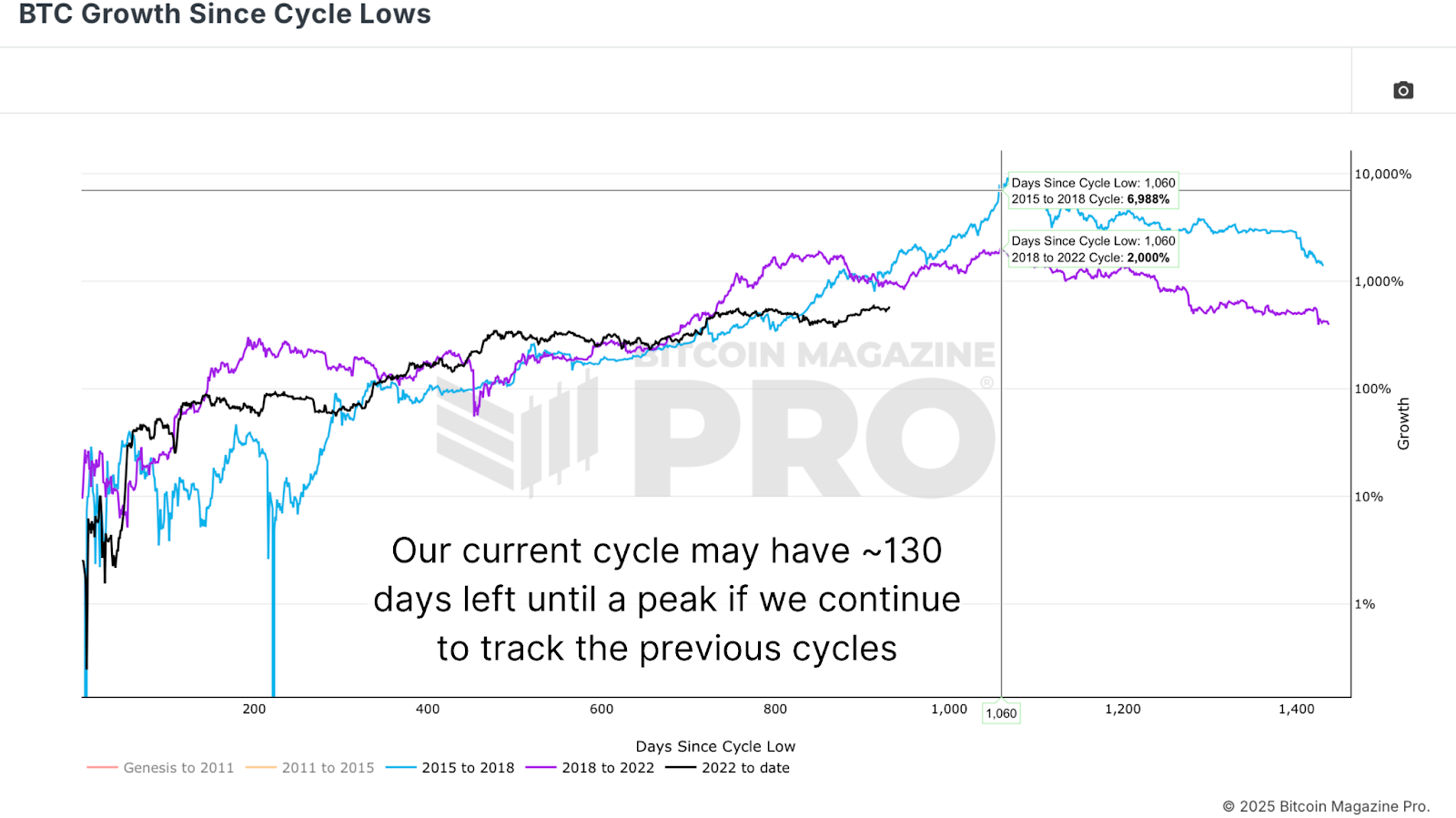

Timing is as important as the evaluation. The analysis of BTC growth since the minimum cycle path illustrates that the previous Bitcoin cycles have reached the peak almost exactly 1,060 days from their respective minimums. We are currently about 930 days in this cycle. If the model is valid, we can estimate that the peak can arrive in about 130 days. The increases in historical prices based on fomobili often occur late in the cycle, causing a price made, a proxy for the average base of investors, to increase rapidly. For example, in the last 130 days of the 2017 cycle, the price has created has grown by 260%. In 2021, it increased by 130%. If we take on a further discharge of growth due to decreasing yields, an increase of 65% from the current $ 47K of the price brings us to about $ 78k by 18 October.

With a price made from $ 78k expected and a conservative MVRV lens of 3.5, we reach a potential Bitcoin price peak of $ 273,000. Although this may seem ambitious, historical parabolic peaks have shown that these moves can occur in weeks, not months. While it may seem more realistic to expect a peak closer to $ 150k to $ 200k, mathematics tests and chain suggest that a higher evaluation is at least in the reign of the possibility. It is also worth noting that these models adapt dynamically and if the euphoria of the late cycle enters, the projections could quickly accelerate further.

Conclusion

The forecast of the exact peak of Bitcoin is intrinsically uncertain, with too many variables to take into account. What we can do is position ourselves with probabilistic framework rooted in previous historical data and on chain. Tools such as the MVRV ratio, the terminal price and the top of the top have repeatedly demonstrated their value in the anticipation of market exhaustion. While a target of $ 273,000 might seem optimistic, it is rooted in past models, current network behavior and logical for cutting the cycle. Ultimately, the best strategy is to react to data, not at rigid price levels. Use these tools to inform the thesis, but remain quite agile to obtain profits when the wider ecosystem begins to report the upper part.

For further immersion searches, technical indicators, real -time market notices and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.