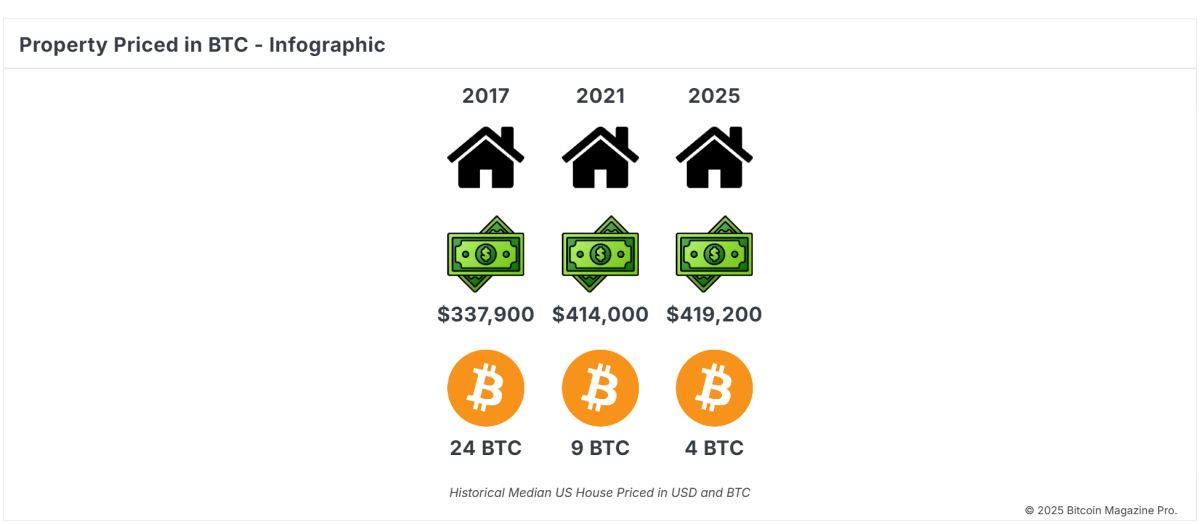

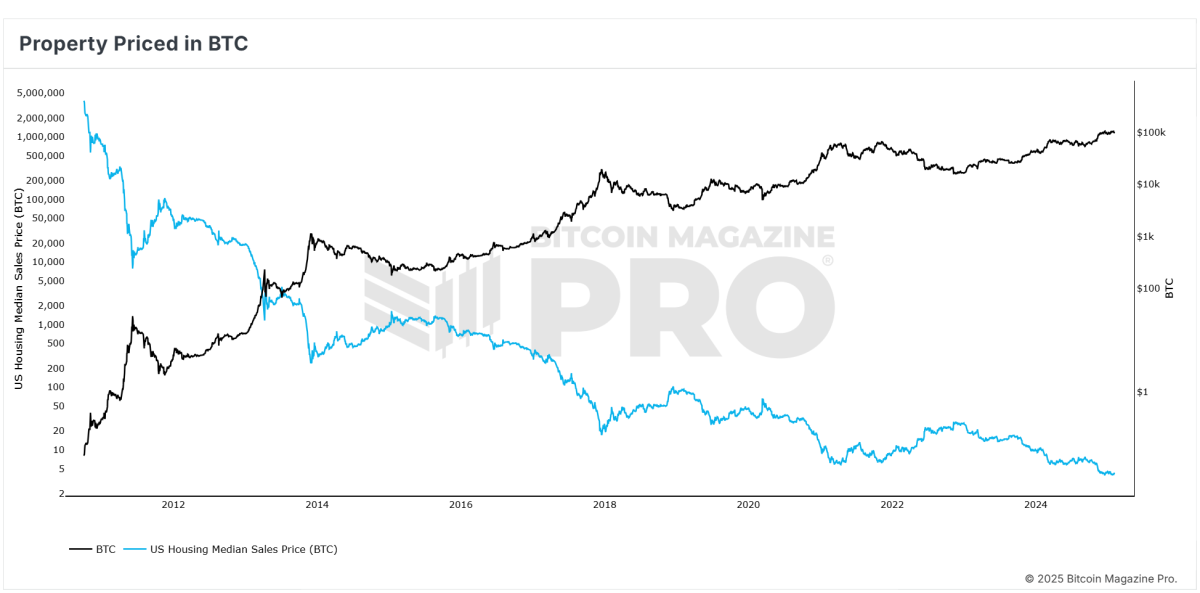

In today’s dynamic economic panorama, expert investors are re -evaluating their wallets and considering the potential of Bitcoin as an alternative to traditional activities such as the real estate sector. With a limited potential and transformative growth, Bitcoin presents a convincing case for far -sighted investment strategies.

Summer: the illusion of stability

The real estate sector has long been considered a safe refuge to preserve wealth. However, the real estate market is not immune to systemic risks such as increases in interest rates, government intervention and economic recessions. In addition, real estate investments often require significant maintenance costs, taxes and liquidity sacrifices.

Bitcoin, on the contrary, offers unparalleled portability, confiscation resistance and immunity from local economic or geopolitical interruptions. Unlike property, Bitcoin has no maintenance or physical constraints.

Bitcoin ascent as a value shop

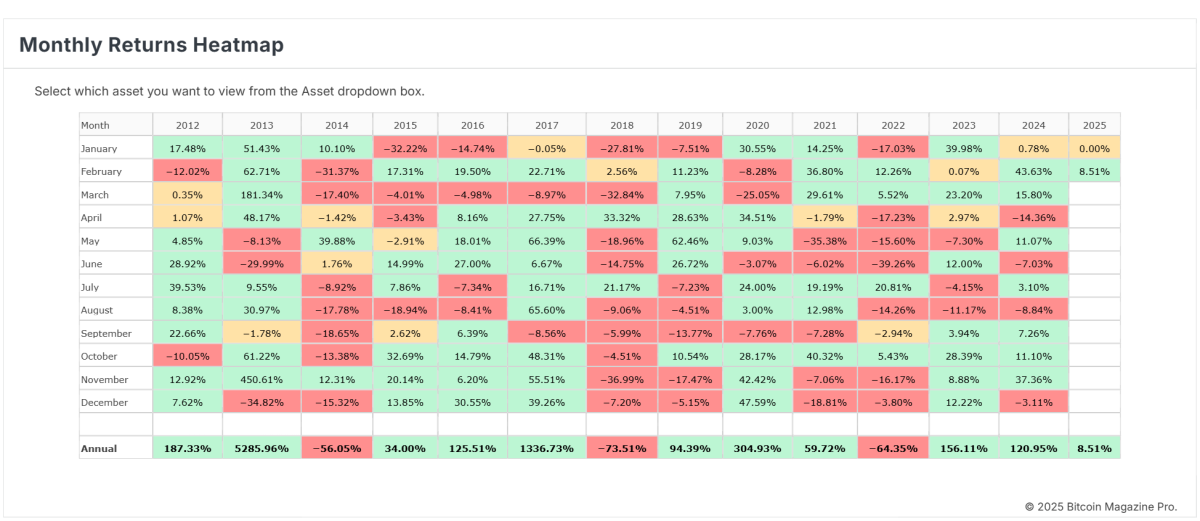

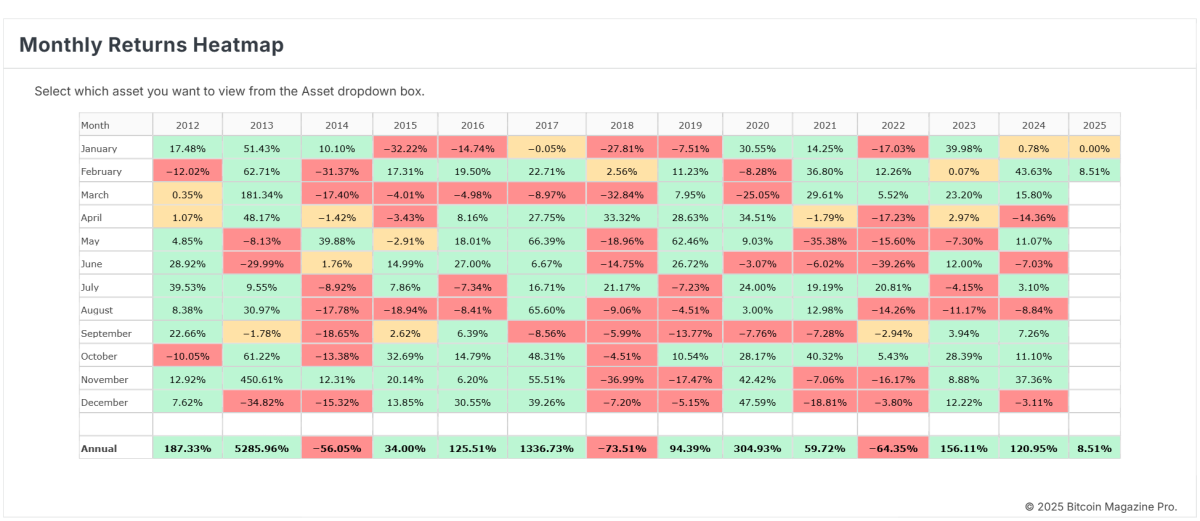

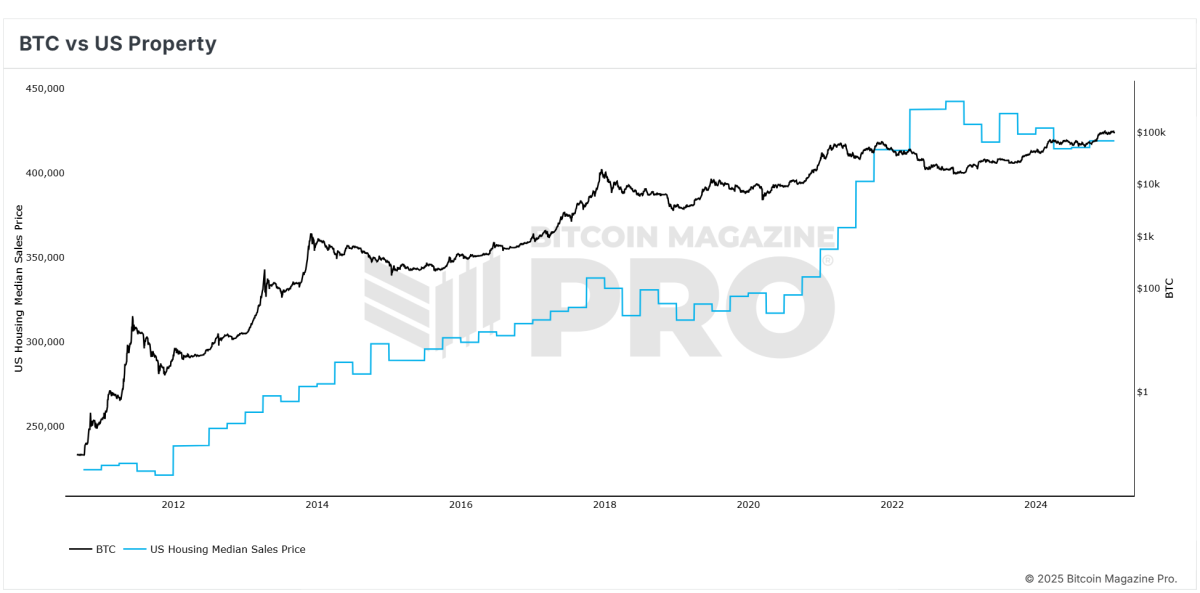

The limited offer of 21 million Bitcoin coins establishes it as “digital gold” for the 21st century. Over the past ten years, Bitcoin has constantly overperformed other activities of activities, providing exponential returns despite volatility.

In comparison, the appreciation of the properties is often linked to the inflation and monetary policy of the government, which can decrease its true value over time. Bitcoin, on the other hand, operates on a deflationary model, guaranteeing scarcity and preserving purchasing power.

Liquidity and accessibility

Real estate investments often require long transactions, high commissions and significant regulatory obstacles. The sale of a property can take months, bind to capital and reduce agility. Bitcoin, however, offers instantaneous liquidity and can be exchanged 24 hours a day, 7 days a week, during global exchanges. This accessibility allows investors to move their wealth seamlessly through the boundaries.

The data underline Bitcoin’s ability to preserve and grow wealth more effectively than traditional real estate investments.

Cover against inflation

Real estate prices often reflect inflationary trends but cannot significantly overcome them. Bitcoin, designed as a coverage against the devaluation of the Fiat currency, has shown his resilience in inflationary periods. Since central banks continue to print money at unprecedented rates, the finished offer of Bitcoin guarantees that its value is protected from monetary degradation.

Flexibility for modern investors

Today’s investors give priority to flexibility and global access. The real estate sector is a localized and illiquid resource that limits mobility. Bitcoin, on the contrary, is without borders and allows a decentralized property without relying on traditional financial systems. This function is particularly attractive for younger and technology experts who appreciate freedom and control.

A bold vision for the future

Bitcoin is more than a simple speculative resource; It is a financial revolution. By embracing Bitcoin, intelligent investors are positioned in the front line in this paradigm shift. As Bitcoin’s adoption grows, his value proposal becomes increasingly clear: a robust and deflationary activity designed for the modern economy.

Conclusion

While the real estate sector was historically a milestone of the investment wallets, Bitcoin offers a transformative alternative that aligns with the needs of a rapidly evolving global economy. For those who try to preserve wealth, cover inflation and capitalize on revolutionary technology, Bitcoin is the activity of choice. The question is no longer “why bitcoin?” But rather “why not bitcoin?”

If you are interested in a more in -depth analysis and given in real time, consider taking a look at Bitcoin Magazine Pro for precious insights on the Bitcoin market.

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.