Two days ago, atebites account X pointed out that THORChain’s lending service currently does not have enough Bitcoin to repay its creditors.

At the time of posting, the total amount of bitcoins to be refunded to depositors was 1,604, while the lending pool contained only 592 bitcoins.

We need to raise awareness about how bad the shape of Thorchain lending is right now, posing a potential risk to the protocol itself.

As it stands, at current market rates per RUNE, full closing of the loan will mint 24 million RUNE.

1,604 BTC in collateral, 18,258… pic.twitter.com/OykZbMQCdx

—atebites (@ate_bites) January 8, 2025

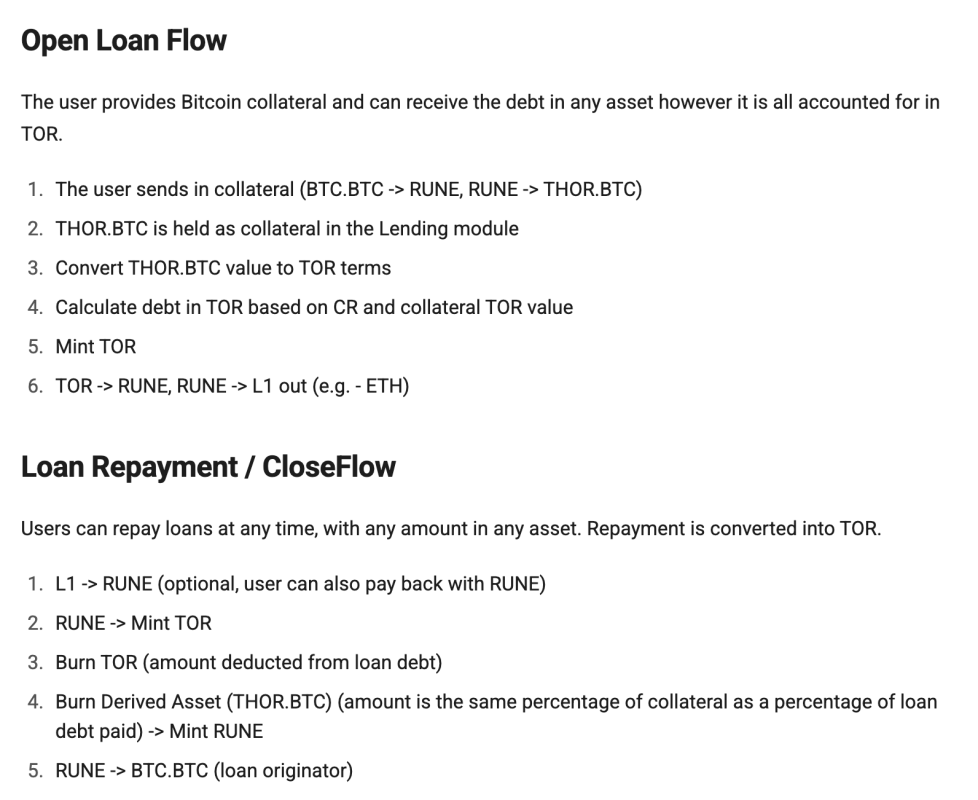

As Lava founder Shehzan Maredia explained in a post on X, when you borrow on THORChain, they sell the bitcoin you provided as collateral for their token, RUNE. When you repay your loan, they sell the RUNE for bitcoin to give you back your collateral.

I predicted Thorchain’s collapse in 2023 when they launched theirs "loan" function, and it’s happening now. The lesson people never seem to learn: any crypto system that can fail, will fail.

When you borrowed on Thorchain, they sold your BTC collateral for their…

— Shehzan (@MarediaShehzan) January 10, 2025

The actual mechanics of how this works are a little more complex and are detailed on the THORChain website.

Check out the screenshots from the website below:

The main problem in this scenario is that half of the value borrowed in US dollar denominations was borrowed when bitcoin was trading at prices significantly lower than what bitcoin is trading at today, according to atebites.

This means that for THORChain to meet its current demands, it will have to mint over 24 million RUNES (as of January 8th). While this would only represent about 8% of RUNE’s circulating supply, it would lead to a reduction in the asset’s price, which would give THORChain even less purchasing power as they attempt to buy back bitcoin on behalf of their creditors.

If traders started selling RUNE beyond that, THORChain’s ability to purchase the necessary amount of bitcoin to redeem its creditors would decline further.

This could lead to something similar to the Earth/Moon death spiral we saw in 2022.

That said, well-known project supporter Erik Voorhees shared that THORChain’s lending service works as intended and that there is no foreseeable danger:

Thorchain continues to work as expected.

Yes, loan repayments cause downward pressure on the price of RUNE, but the scale is not dangerous.

If you’re worried, go pay off your loan.

— Erik Voorhees (@ErikVoorhees) January 10, 2025

A lead developer of THORChain who goes by the name of Nine Realms on X also stated that THORChain is resilient:

1/ Address community concerns

There has been a lot of discussion recently about the state of the network and the pending liability of the lending protocol.

Let’s dive into the facts to shed light on what’s really happening and why we remain confident in THORChain’s resilience.

— Nine Realms (@ninerealms_cap) January 10, 2025

That said, if you still feel nervous about lending THORChain your bitcoin as collateral for a loan, you may want to redeem it. If I used the service, I would.

This article is a Take. The opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.