Each Bitcoin Price Bull market has to date has followed a family model of explosive rise followed by strong holds, with every cycle that offers lower percentage earnings than the last. This phenomenon, known as decreasing returns, has become one of Bitcoin’s most persistent narratives. The question is now whether this cycle follows the same trajectory or if Bitcoin’s maturation as a class of activity could bend the model.

Bitcoin price and decreasing returns

So far this cycle have witnessed about 630% BTC growth with a low cycle compared to maximum all time. This is comparable to over 2,000% in the previous bull market. To combine the size of the last cycle, Bitcoin should reach around $ 327,000, a stretch that seems more and more unlikely.

Evolution of Bitcoin prices dynamics

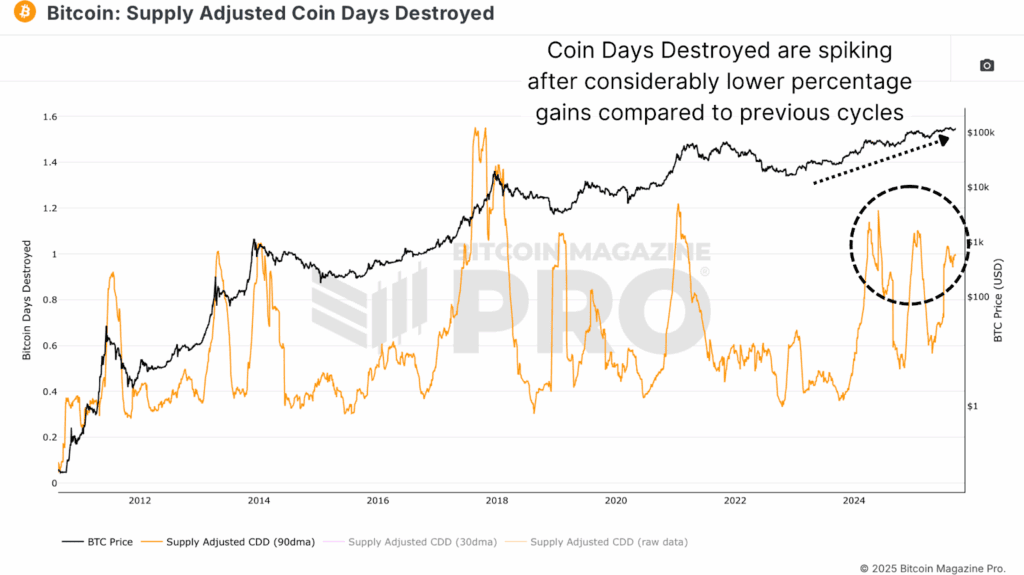

One of the reasons for the rates to the less explosive rates in the Destracted Coin Destroned metric (CDD), which keeps trace of the speed of the older coins that move on the chain. In past cycles, such as the 2021 bull market, the long -term owners tended to sell after Bitcoin had already appreciated ~ 4x from its local minimums. However, in this cycle, similar levels of use of profits have occurred after only 2x moves. More recently, the CDD peaks have been activated by increases in prices even smaller than 30-50%. This reflects a basis of maturity investors: long -term owners are more willing to make earnings previously, which dampens the parabolic progress and the market structure is apply.

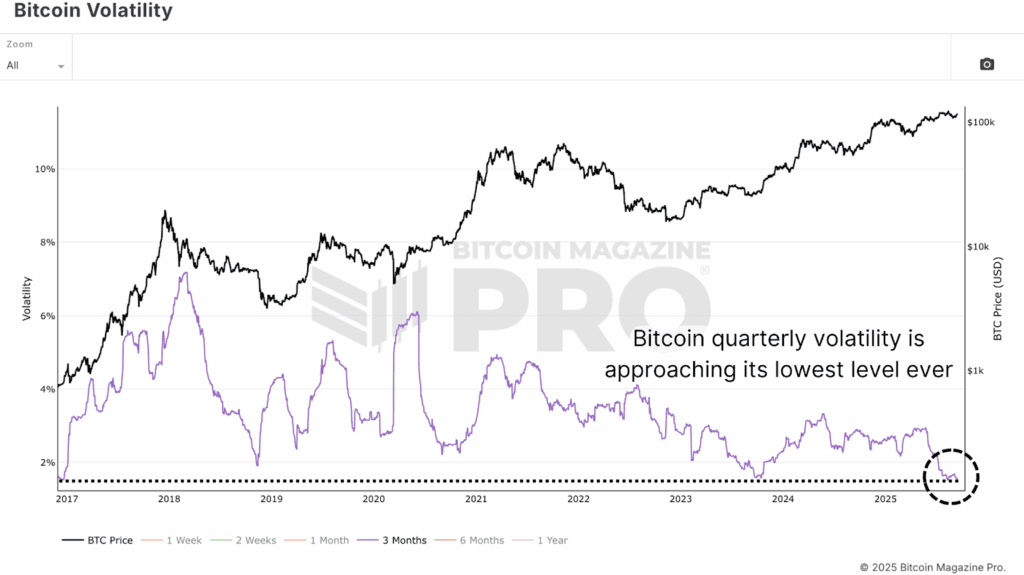

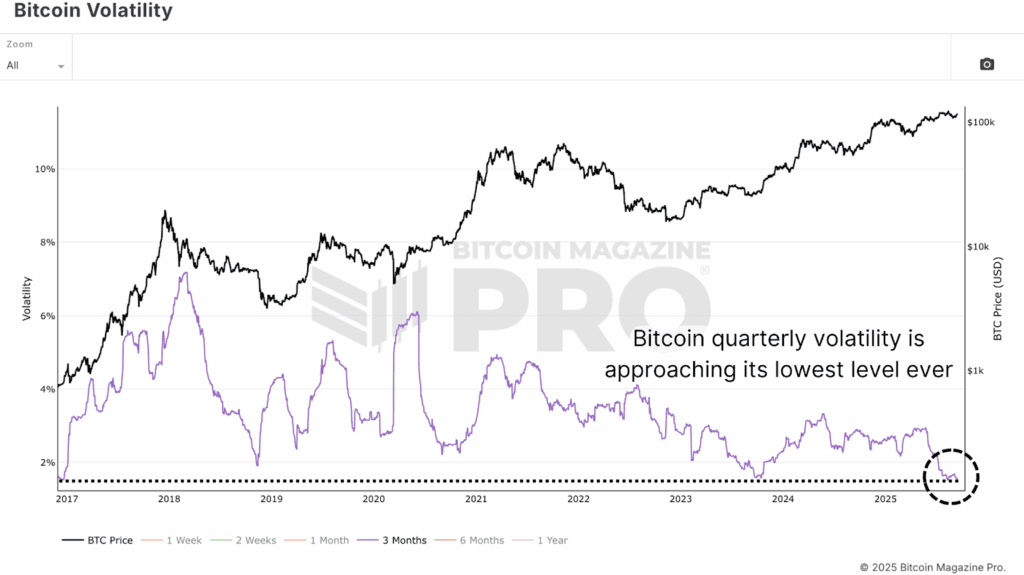

Another factor is Bitcoin’s volatility. Bitcoin’s quarterly volatility has been constantly lower. Although this reduces the chances of extreme top, it also supports a healthier long -term investment profile. A lower volatility means that the capital affluses needed to increase the price increase, but it also makes Bitcoin more attractive for institutions that seek adequate exposure to risk.

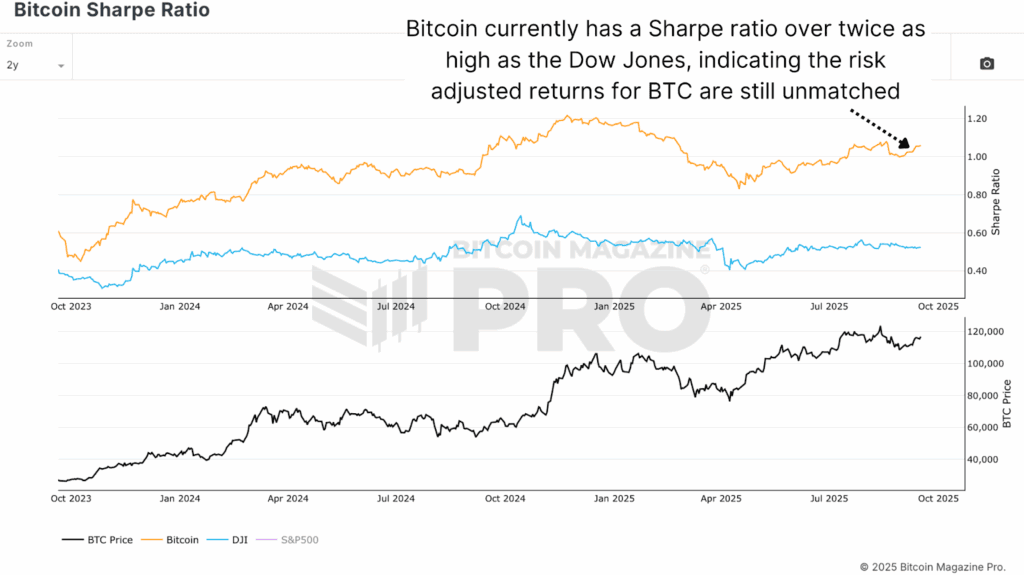

This presents itself in the Bitcoin Sharpe report, where Bitcoin currently has more than double than that of the industrial average of Dow Jones. In other words, Bitcoin still offers higher returns compared to its risk, even if the market stabilizes.

Bitcoin price and gold relationship

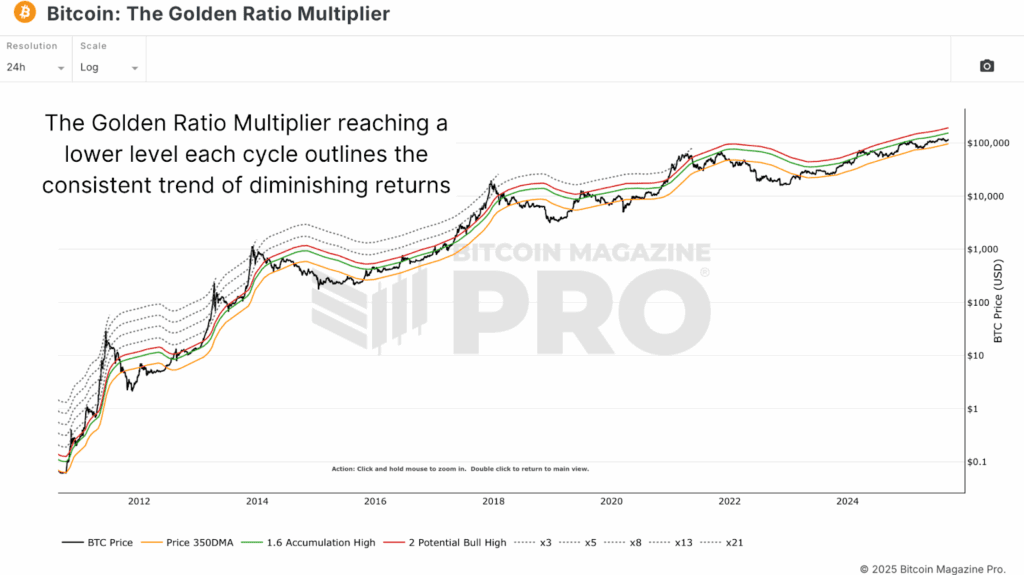

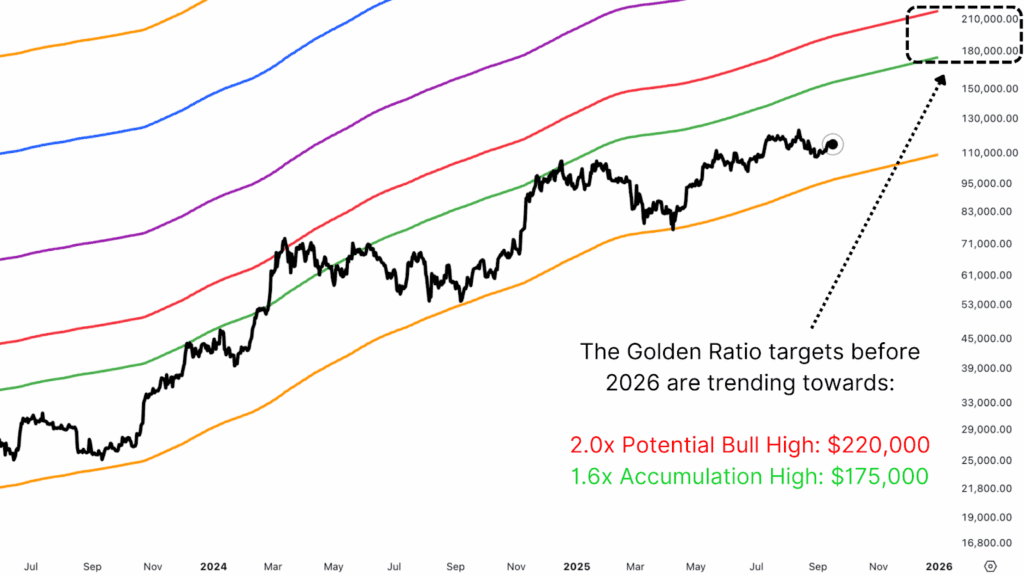

From a technical point of view, the multiplier of the gold relationship provides a framework to project decreasing returns. Each cycle top is aligned with gradually lower fibonacci multiples of the 350 -day mobile average. In 2013, Price reached the 21x band. For the upper part of 2017, it reached the 5x band and in 2021, the 3x band. This cycle, Bitcoin has hitherto tagged the 2x and 1.6x gangs, but a push to 2x levels remains possible.

Project these levels of 1.6xe 2x forward, based on their current trajectory, suggests a goal between $ 175,000 and $ 220,000 before the end of the year. Of course, the data does not take place exactly in this way, since we would see the 350dma move more exponentially when we got on these higher objectives. The point is that these levels are constantly evolving and constantly indicate higher objectives as the bull cycle advances.

Bitcoin price in a new era

Decreased returns do not reduce Bitcoin attractiveness; If anything, they improve it for institutions. The less violent doors, potentially elongated cycles and the strongest performance adequate to the risk contribute to making Bitcoin a more investable resource. However, even if Bitcoin matures, its advantage remains extraordinary compared to traditional markets. The days of 2000%+ cycles could be behind us, but the era of Bitcoin as a traditional activity, institutionally, is only at the beginning and will probably still provide unparalleled returns in the coming years.

For deeper data, graphic designers and professional insights on Bitcoin price trends, visit Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more experienced insights and market analysis!

Disclaimer: This article is only for information purposes and should not be considered financial advice. Always do your searches before making any investment decision.