The cryptocurrency market continued its decline on Thursday, with Bitcoin’s price briefly falling below $110,000 before regaining some ground.

Queen Gekko Data It showed that the price of Bitcoin fell to $107,500 from $110,400, which represents a decline of 3% in the last 24 hours

Most major altcoins have followed the same path. Nine of the top ten non-stable assets traded lower, losing between -0.9% to -5.3%.

This decline came after a significant increase in Bitcoin transfers from miners to exchanges, indicating growing selling pressure.

Just a few weeks ago, miners were adding to their Bitcoin holdings despite rising costs and low margins. This trend reversed as lower transaction fees led to lower revenues, exacerbated by the April halving and increased network difficulty.

Will Q4 2025 bring another wave of volatility for Bitcoin traders?

Bitcoin price continued its weekly decline, trading near $107,500 after falling nearly 10.8% over the past seven days.

Similar sell-offs have been seen in the late stages of previous market cycles, often reflecting caution among investors.

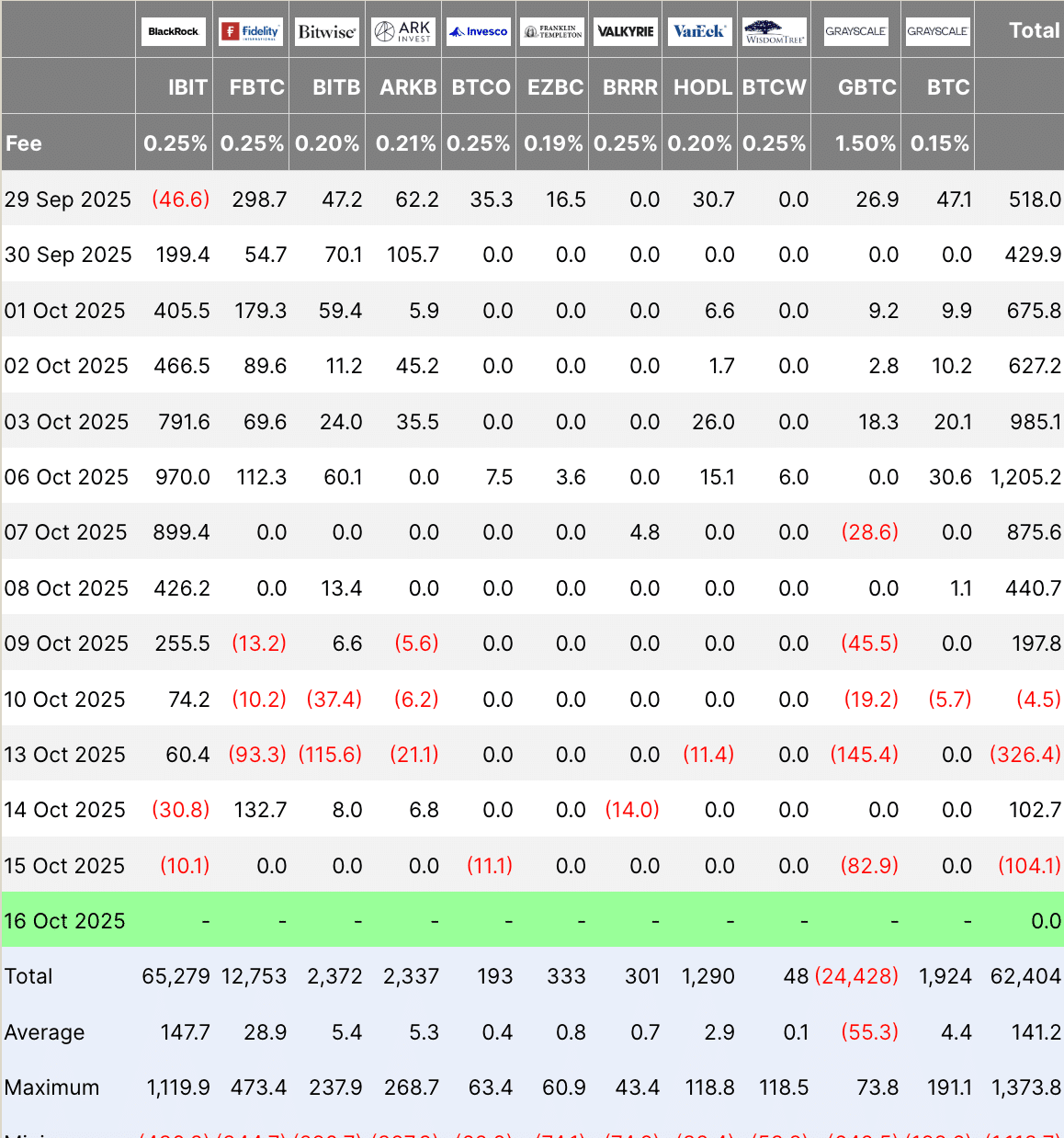

Data from Farside It appears that Bitcoin ETFs have seen outflows of more than $108 million since the start of the week, adding to selling pressure in the market.

according to deerbit data, Options traders have placed more than $1.7 billion in bets that the price of Bitcoin will rise above $130,000 before the end of the year.

Polymarket Data It suggests that participants assign a better than 50% chance to this scenario in 2025.

(Source: Polymarket)

Analysts at CryptoQuant Named The recent $19 billion drawdown is considered a “leverage flow,” signaling a market reset rather than the beginning of a long decline.

During Friday’s collapse, spot volume reached $44 billion (near cycle highs), futures $128 billion, while OI fell by $14 billion with only $1 billion in long BTC liquidations. 93% of the divestment in investment was not forced – this was a controlled deleveraging, not a series.

This is a very ripe moment for Bitcoin. pic.twitter.com/sTrziRUXXo

— Axel

Adler Jr (@AxelAdlerJr) October 14, 2025

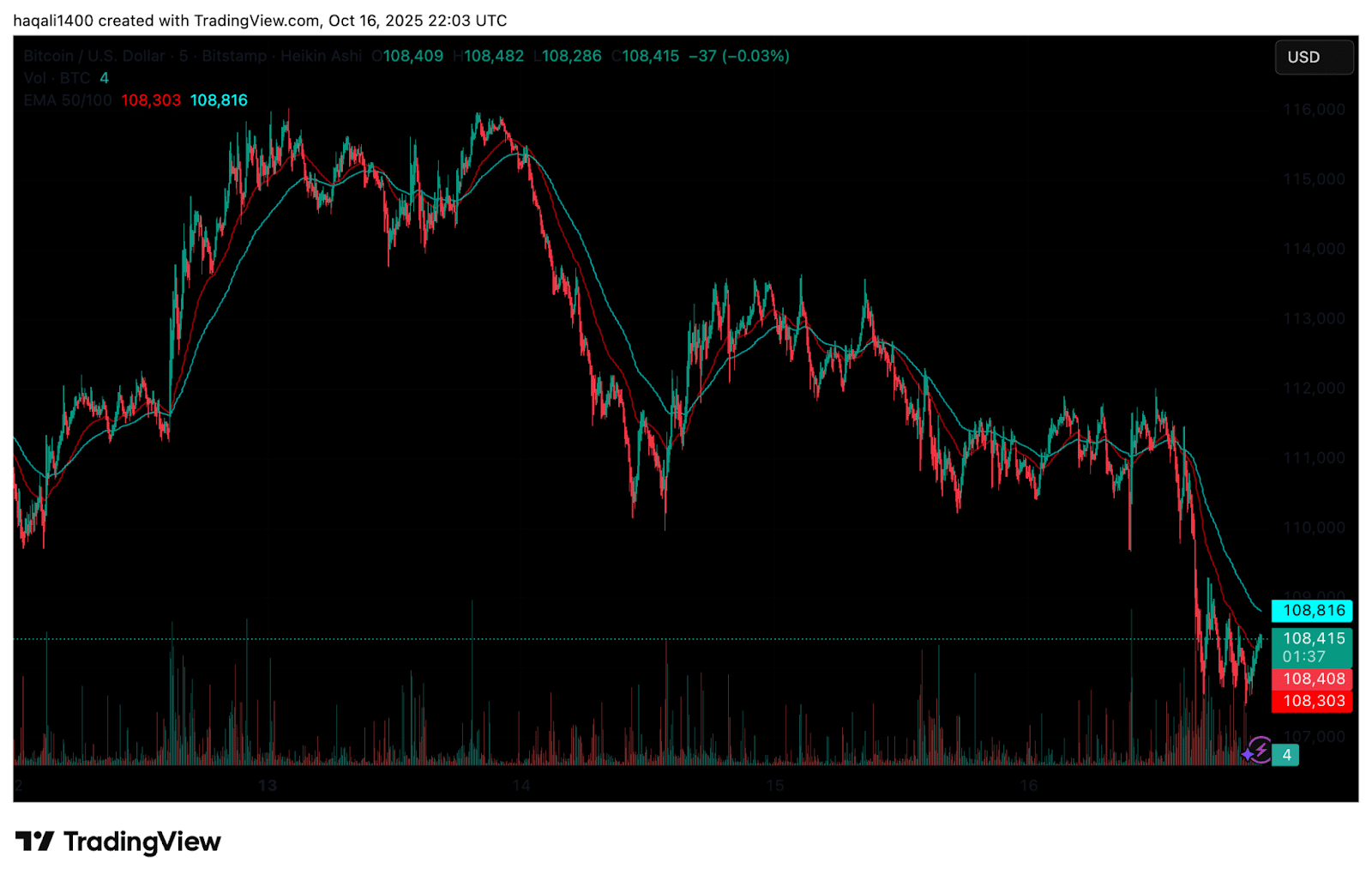

Technically, Bitcoin’s weekly chart shows that the price is sliding below a bull market support range, an area defined by the 20-week simple moving average and the 21-week exponential moving average.

(Source: Bitcoin USD, TradingView)

The level has historically been a strong focus in past sessions. Bitcoin is now hovering near $108,000, facing a major test.

A close below this range could turn sentiment bearish in the short-term, opening the door to the $100,000-$102,000 support zone.

Discover: The best new cryptocurrencies to invest in 2025

Bitcoin Price Prediction: Will the 2025 “Trump Tariff Collapse” Repeat 2020 Bitcoin Pattern?

Analyst Dan Crypto He said Broader conditions still look supportive. With stocks and gold approaching record highs, strong liquidity may help Bitcoin price remain stable around current levels.

$ Bitcoin It was struggling around the bull market support range but is losing it again. It is important to stay around this area on higher time frames and weekly closes.

As long as stocks and gold remain near their all-time highs, I think BTC has a good chance of holding this area. pic.twitter.com/5C5u2c7Q3x

— Dan Crypto Trades (@DaanCrypto) October 16, 2025

Historically, late-year trading often brings extreme volatility. The market may see another bout of volatility heading into the final quarter of 2025, before a clearer trend emerges.

Analyst Tedbellose subscriber Chart comparing Bitcoin’s 2020 “Covid collapse” with Trump’s recent “China tariff collapse.”

$ Bitcoin It was reinforced after last week’s crash.

Sentiment is at an all-time low, and people are panic selling "it’s all over" On the schedule.

This does not happen at the top, but at the bottom. pic.twitter.com/6SQ4F7yPj5

– Ted (@TedPillows) October 16, 2025

The two trends show similar behavior. In 2020, Bitcoin’s sharp decline was followed by a rapid recovery and a long rally to new highs. The 2025 chart follows the same pattern: a deep sell-off, then a base forming near the lows.

(Source: X)

The candles present indicate surrender. Recorded long wicks and high selling volume are indicators that panic selling may be coming to an end, and this is usually a sign of a bottom.

At the time of his analysis, Bitcoin was trading at approximately $110,000, which may form a double bottom pattern, similar to the March 2020 pattern.

The symmetry of the chart suggests that market fears could be at their peak, and this could be the beginning of a recovery once the selling pressure subsides.

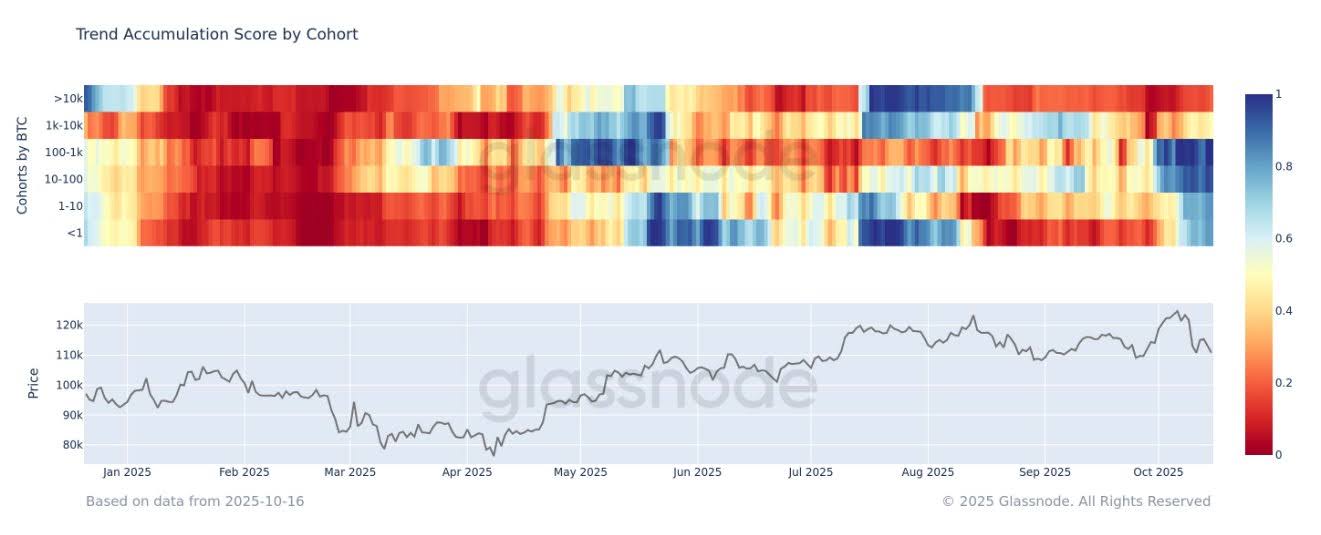

according to Glassnode dataSmall Bitcoin holders continue to accumulate their holdings.

Charts show that the accumulation of wallets containing 1 to 1,000 BTC has been increasing since the end of September.

(Source: X)

Meanwhile, large holders with more than 10,000 BTC have either reduced their purchases or slightly reduced their holdings, indicating that central accumulation has stopped.

The move signals new confidence among retail and mid-sized investors as Bitcoin trades at a price between $110,000 and $115,000.

Historically, this type of accumulation by smallholders has been commonly observed to precede recovery periods that occur following large-scale market corrections.

Discover: The best new cryptocurrencies to invest in 2025

Post: Will Bitcoin recover after $5.6 billion mining equipment sale? The post Analysts Opportunity at $110K Support and 2020 Pattern Bottom appeared first on 99Bitcoins.