- Bitcoin’s MVRV ratio is close to a critical outbreak, as benefiting from future markets rises rapidly.

- A decisive step exceeding $ 95,783 can open the rapid upward trend, but the heavy ranking is still threatening.

Bitcoin [BTC] The MVRV ratio has recently intended at 2.13, less than the simple moving average for 365 days (SMA365) of 2.14-is a decisive axis historically for medium-term upward repercussions.

However, despite this promising setting, Bitcoin should achieve a weekly confirmed closure over SMA365 to check the authenticity of the potential trend.

Therefore, the market participants closely monitor this intersection, knowing that it can represent the beginning of the strongest recovery phase.

In addition, failure to restore this Bitcoin level to renew the sale pressure, undermines the current momentum.

Bitcoin – Is higher speculation?

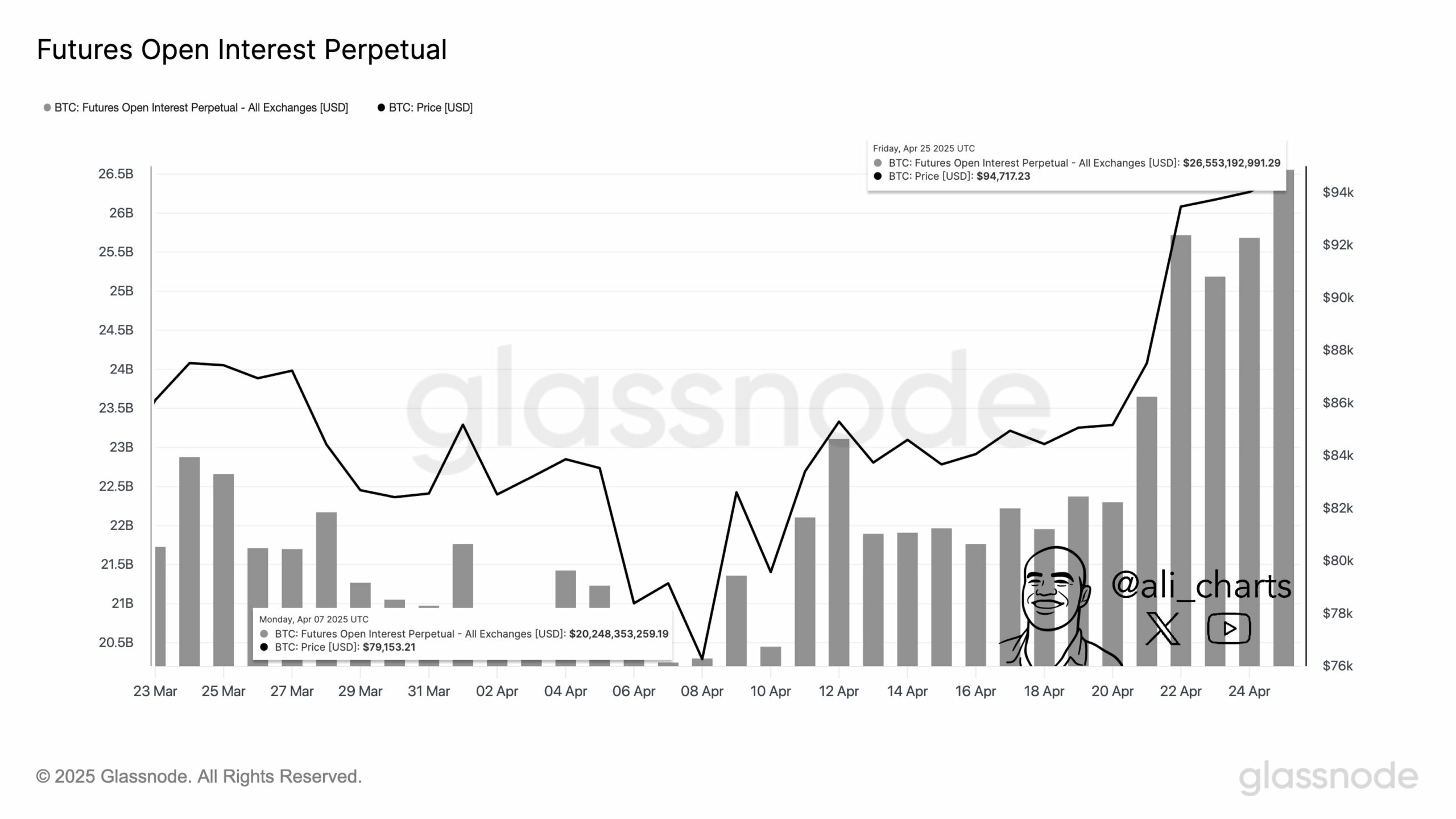

The open interest through the future bitcoin market has increased by 20 % in the past twenty days, which now exceeds 26 billion dollars, indicating an aggressive accumulation of speculation sites.

Moreover, the estimated financial leverage rate increased by 0.99 %, indicating that merchants are increasingly dependent on the margin to inflate their bets.

However, although the height of the leverage often increases the movements of short -term price, it increases simultaneously from the possibility of flying filter formations if the feelings suddenly turn.

Source: x

BTC technical price structure – Does the penetration lose Steam?

Bitcoin has recently erupted from the formation of a falling wedge, usually an emerging technical signal, indicating the possibility of a constant head direction.

However, at the time of the press, Bitcoin was traded at 94,036 dollars, and slipped by 0.71 % over 24 hours.

This simple decline highlights that sellers are still defending the resistance area of $ 95,783. Therefore, Bitcoin needs a clean daily closure above this level to verify the validation of the bullish preparation and goal to achieve more gains.

On the contrary, the failure to violate this resistance can see the price slide towards the support level of $ 83,462, as buyers previously showed a strong benefit.

Source: TradingView

Decrease in stock to flow-is the scarcity model under pressure?

The shares ratio to the Bitcoin, and the measuring the scarcity of scarcity, decreased by 22.22 %, adding short -term pressure to the traditional bullish model.

However, the decrease does not completely undermine the basics of bitcoin in the long run.

Instead, it emphasizes that immediate price movements are now more sensitive to liquidity trends, dynamics to benefit from investors, and investor morale transformations.

Source: Cryptoquant

Filter Map analysis – Where can BTC move after that?

The filtering map shows dense and long liquidation sets for Bitcoin ranging from $ 93,000 and $ 94,000, creating a critical support area.

The constant decrease can lead to below these levels to a series of references, which may lead to a decrease in the price to $ 91,000.

On the contrary, if you break Bitcoin and more than 95,783 dollars, the liquidation density is greatly rejected, which paves the way for a rapid upward move with the minimum resistance.

This lower upper liquidation pressure strengthens upscale expectations, provided that it picks up momentum again.

Source: Coinglass

Categorically, Bitcoin stood at a critical decision point.

The increasing financial lever, determining the percentage of MVRV and Predge Breakout, indicates that my upward continues if the resistance of 95,783 dollars is turned.

Therefore, if Bitcoin maintains strength and removes this level, the gathering may extend strongly. However, the failure to do so is likely to expose Bitcoin to severe corrections towards low liquidity areas.

Source: https://ambcrypto.com/will-bitcoin-rally-higher-95k-draintance-holds-the-andware/