A $50 million minting window has just opened for a new dollar-pegged stablecoin, and traders are wondering if this is the push ONDO needs for crypto.

STBL.com, the platform behind the USST dollar token, said on Friday that it has selected Ondo Finance’s USDY as its primary collateral, allowing up to $50 million in new USST issuance.

partnership, Announce Via centers in Dubai, London and New York, STBL plans to expand its dollar liquidity using token US Treasuries as backing, October 10 shows.

Discover: 16+ new and upcoming Binance listings in 2025

Why is USDY-USST integration important for stablecoin design?

USDY is a tokenized, yield-generating cash product backed by US Treasury securities and short-term bank deposits, designed for non-US users.

USST, issued by STBL, is Stablecoin for payment Pegged 1:1 to the dollar and backed by real assets. Its design separates USST from the yield flow through a separate claim, helping the peg remain constant while allowing issuers to retain the yield.

USDY, the Ondo “yield coin,” gains value from the underlying interest. Ondo reinvests the interest, updates the USDY price monthly, earns the spread, and charges a 0.2% redemption fee.

STBL has now selected USDY as lead collateral for up to $50 million in the new USST issuance. The move aims to combine hyper-collateralization, on-chain fee management and markdowns, and institutional-level asset backing.

“The design of stablecoins must keep up with reality: the world is moving towards token reserves,” said Avtar Sehra, CEO of STBL.

The integration could boost demand for USD through STBL’s minting process, expand its role as collateral for real-world assets and enhance Ondo’s reach via total value locked, integrations and on-chain activity.

ONDO primarily governs the Ondo ecosystem, but the growth in USDY usage, coupled with product fees and network effects, has been the main driver of the token narrative.

Any real price movement depends on coin volumes, DeFi listings expanding USDY utility, and new partnerships.

The STBL update emphasizes cross-chain control of collateral regulations, as well as fee paths, and describes the system as multi-layered and over-collateralized.

according to OndoTreasury bonds and bank deposits back the US dollar, which is issued outside the United States. The combination seeks to demonstrate that institutional-grade collateral can expand the supply of stablecoins without losing liquidity.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

ONDO Price Forecast: Is ONDO Crypto preparing for a major breakout after USDY collateral news?

According to Koenjiku, it was ONDO commerce At a silent level of around $0.90 for the last 24 hours, with an approximate volume of $180-186 million per day.

(source: Koenjiku)

Ondo USDY, a money-generating stable asset, has an active supply of around 620-625 million tokens and is valued at between $675-690 million. The weak reaction indicates that traders did not receive the new news on STBL collateral with significant changes in market sentiment.

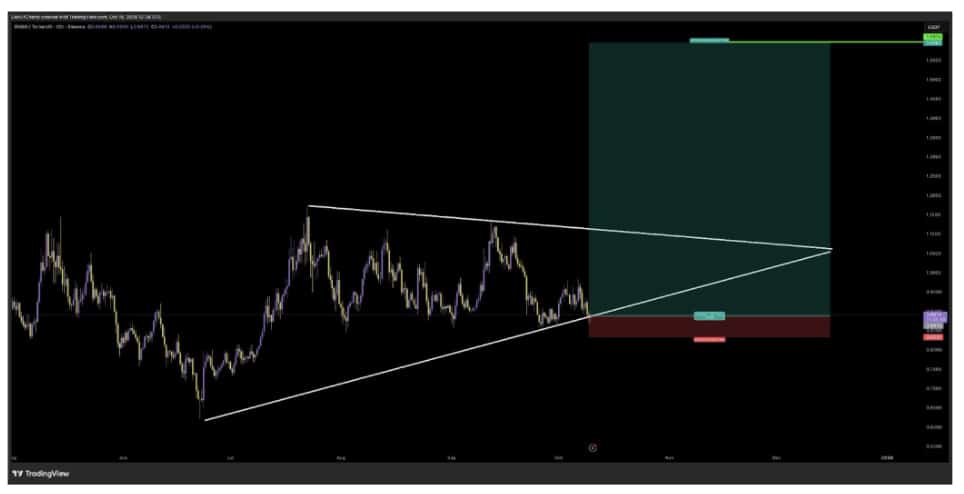

According to the chart owned by analyst DonOfCharts to publishONDO/USDT is developing a symmetrical triangle setup that tends to lead to breakouts.

If you don’t like money

Don’t enter this $ ondo commerce pic.twitter.com/QhfOfclSaa

– Don (@DonaldsTrades) October 10, 2025

The token is currently trading around the $0.89 region, and is based on the lower support trend line in the triangle, which has been maintained since July.

(source: X)

The upper bound is located around $1.05-$1.10, marked by previous swing highs. A decisive break above that area could push ONDO towards the expected target near $1.59, which would imply a 70% upside from current levels.

Right now, ONDO appears to be in a consolidation phase within its broader bullish structure. Traders are watching the support area at $0.83 closely. A drop below this level could weaken the current bullish setup and expose the token to short-term downward pressure.

discovers: 9+ Best Memecoin to Buy in 2025

Join the 99Bitcoins News Discord here to get the latest market updates

Will STBL USDY opt for a major breakout of ONDO crypto price? appeared first on 99Bitcoins.