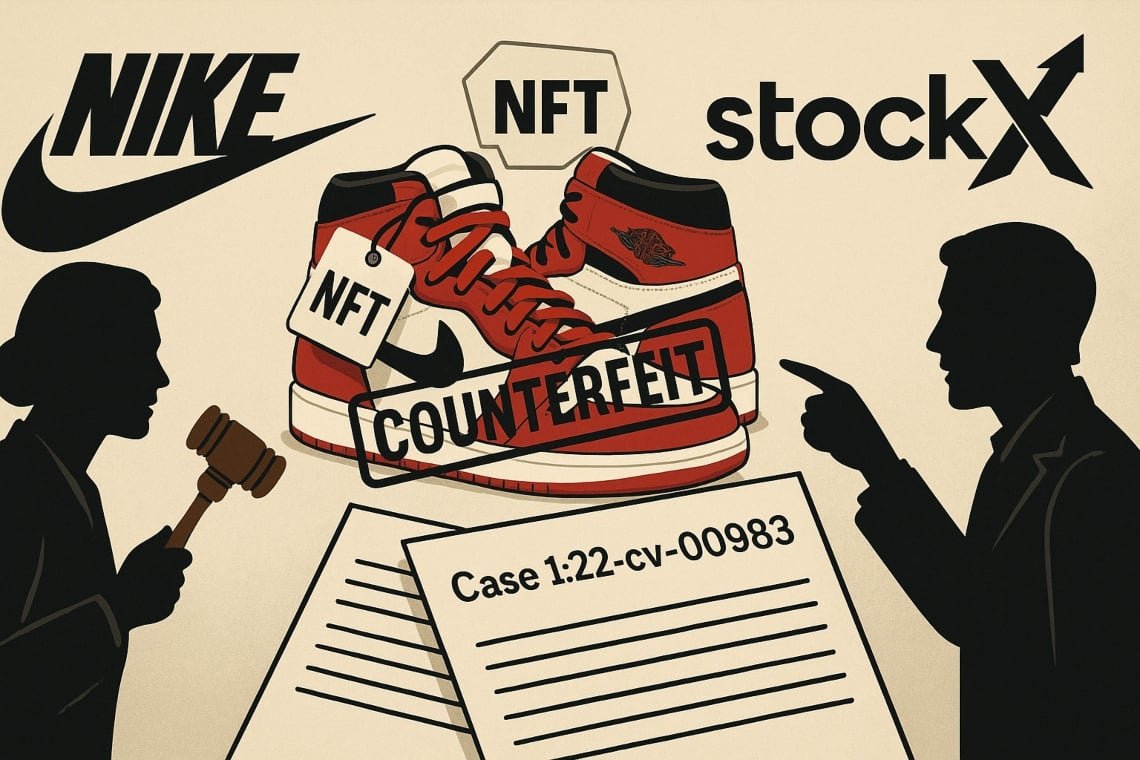

An agreement submitted on August 29, 2025, in New York And the closure of the dispute between Nike and Stockx before the expected procedures: the case concludes with Separation with bias From all claims.

The decision remains in advance, confirmed by Reuters and the court documents related to the federal case 1: 22 – CV – 00983, which was made from selling 37 pairs From fake sports shoes, which is a decisive component of the market and the brand protection in the digital field.

It should be noted that the issue is not only legal, but also works.

According to the data collected by our editorial team from the federal list (1: 22 – CV – 00983) and the General Court documents, the issue of 37 pairs appeared during the discovery stages and an impact on the trial schedule.

Industry analysts note that, after similar provisions, the platforms have implemented stricter authentication controls on average within 12-18 months of general exposure to litigation, as shown in similar cases discussed in this in-depth analysis.

- What happenedA settlement outside the court, without a hearing, a case was rejected with new procedures on the same facts.

- where: In the Federal Court South New York areaCase file 1: 22 – CV – 00983.

- Why do it matterIt puts a practical precedent on how to deal with NFTS associated with physical assets and platform responsibilities.

The deal was closed in New York: What is inside

With the agreement on August 29, 2025, the parties closed the conflict through a Separation with biasWhich prevents the reopening of the conflict itself.

Avoid decision a General rulingReduce Legal costsAnd reduce the risk of reputation damage. the Economic terms It has not been revealed, most likely because of Confidential itemsA common practice in NFT and Property Properts disputes, as shown in this article.

In this context, the previously scheduled legal procedure was canceled.

The basic timeline

- 2022 – Nike Sels Stockx to use sport shoes in “” “cellar“NFT group.

- March 2025 – An order from the judge Valery Capone Selling sale 37 pairs One of the fake sports shoes associated with transactions on the platform; Other things were postponed to the trial.

- August 29, 2025 – Settlement and separation with bias in SDNY: The scheduled trial does not occur.

What the ruling says

Recognized decree Legal responsibility To sell 37 pairs of unreliable sneakers, which appeared during checks. Some major aspects should still be determined, including use trademark In Nfts and capabilities Consumer confusion.

The interesting aspect is that these points did not receive a final ruling, as they were overlooked through the settlement of the court. A similar case that is exposed to the legal definition files of NFTS is available in this analysis.

The controversial issue: NFT-CEIPTS or digital products

The heart of the conflict is related to the nature of NFTS “cellar”. For nike, use Distinguished signs In the symbols, I produced unauthorized The effect of supportIt is likely to be misleading about the actual brand sharing.

For Stockx, serve NFTS K Digital receipts Associated with stored physical goods, tools for Tracking Not independent products.

In the absence of uniform regulatory guidelines, the situation clarifies how the platforms should be balanced Information and promotion In the third party brands display. An in -depth look at the NFT regulations is available here.

Impact on brands and markets

- More tight controls On the supply and documentation chain when connecting NFTS and physical goods.

- Useful design Among the digital assets: Avoid the elements that may indicate that there is no Care Or partnership.

- Risk ManagementExecuting verification records, reviews by third parties, and fast Seizure Procedures in the case of forgery.

Recommended measures to protect intellectual property in digital space

- Extension of recordings To include digital assets, certificates and market services.

- Contractual items Especially for the use of brands, image rights and limits of use in smart contracts.

- The watermark on the chain and verification Systems that link symbols and physical assets uniquely.

- Anti -counterfeiting policy With escalation and cooperation with Brand protection Experts.

- Bible care On sellers and creators, with automatic suspension thresholds in the case of abnormal cases discovered.

Risks and responsibilities in the digital sports shoe market

The issue highlights how the regulatory ecosystem can enhance it Forgeryand LitigationAnd increase Legal responsibility For platforms.

The agreed closure, while avoiding a final legal precedent, confirms this Mediation Do not exempt from a duty Censorship. In practice, the threshold of tolerance of authentication errors is significantly reduced.

What is changing today

- Clear criteria For the relationship between NFTS and material assets: more transparency is needed for ownership, custody and rights.

- Supervision For markets: It is necessary now to implement Before the examination Post -sales and checks.

- Wise communicationThe views and descriptions of digital assets should be avoided mysterious Messages about actual affiliation with the brand.

What is still open

The many aspects remain without final to ruleFor example, when to form Nft A Commercial use The brand? What are the limits The first sale How does exemptions apply in the digital field?

The solution, at the present time, will be defined A case according to the case It will depend on the processes and facades adopted by platforms. It should be said that the balance between innovation and protection is still accurate.

Source: https://en.cryptonomist.ch/2025/09/01/nike-vs-stockx-quick-greement-on-nft s-withwal-with-preudice-so-37-carfeit-pairs -at-the-co-chase/