Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

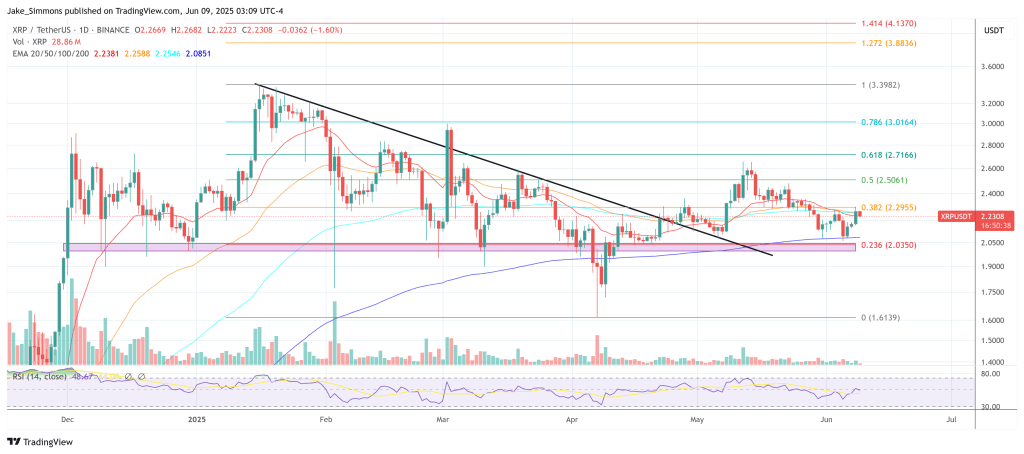

The pseudonym analyst cryptoinsightuk warned that the next important move for XRP could be a trap. In a video published on June 8, the analyst outlined a scenario in which XRP extends to $ 2.30- $ 2.40 in the short term, just to violently reverse in a sharp liquidity denial before any sustainable breakout occurs.

Xrp bull looming transfers?

“I think XRP goes to $ 2.0. I really do it,” he said, adding: “It could come and sweep the maximums here … it could come to understand what, $ 2.30 and then push us down. It would be more pain for everyone, because everyone thinks that we go to the positive side.”

The setting it describes is based on the market structure and on the dynamics of liquidity, in particular the accumulation of rest orders under the current range of XRP. “This here is a concern, a real concern for me,” he said, referring to the growing pool of liquidity below current prices. According to its internal models, these liquidity areas are statistically touched “80% of the time”.

Reading Reading

“Someone is trying to deceive someone here,” he warned. “I’m cautious.” Despite its almost total-affirm XRP allocation which is “95%+, probably more similar to 98%” positioned in XRP-Cryptoinsighting stressed that it is not cheering for a correction. “I don’t want to go down,” he said. “I’m just showing you what I see.”

The analyst proposed multiple structural paths: one in which XRP broke immediately, and another in which he gathers briefly to wipe out the local maximums before rinsed down to form a bullish divergence. “We are in a range of action right now,” he said. “We come out, we swear the ups, so we take the bass and go?”

He has developed the upward divergence model he is looking at, in which the price forms a low bass while the RSI (relative resistance index) prints a higher minimum, a configuration that uses to identify the basic structures. “This is what I would like to see,” he explained.

Wider macro conditions still support

Despite the bearish tactical configuration, the video hit an optimistic macro tone. Will cited four short-term catalysts: The Genius Act on Stablecoin’s supervision, the imminent expiry of deposit in the SEC remedies against Ripple, the July decision window for an ETF Spot-XRP proposal and a renewed accommodating tax policy expectation unleashed by the Trump-Musk television dialogue last week.

“What this really tells us is that there will be money for the press,” he claimed. “Resources everywhere will explode up and, for other specific reasons, XRP probably is even better.”

Moving on to Bitcoin, the analyst observed a continuous decline of the negotiation volume, suggesting the indecision or exhaustion. “There was no volume. There was nothing,” he said about the recent action of the BTC price.

Reading Reading

He highlighted a Futures CME gap of about $ 92,000 – $ 93,000 and added that the analysis of the fixed interval volume indicates a possible Pullback area at $ 96,000 – $ 97,000. “It is probably coming imminent, perhaps this week,” he said of a potential correction, projecting a scenario in which BTC immerses in this interval before resuming his trajectory upwards.

“Does this mean that we squeeze up or go down and take it at the bottom and put that up -and -out divergence structure?” He asked, noting such a divergence configuration at $ 75,000 at the beginning of this year.

The XRP commercial activity increases red flags

In the last hour before the video, XRP had “squeezed with a little volume”, but the analyst urged caution. While the open interests had increased abruptly, the loans remained green, the longest net positioning and the aggregate prize had become red. “This shows me that even if there are still some shorts, longer than the shorts have entered,” he said.

He warned that this imbalance could cause a clear move if the market cannot maintain current levels. “If we now go down and lose so low, we expect a more aggressive and faster move to the downside,” he said, indicating the risk of liquidating lever positions.

The related performances of XRP against Eth and BTC have also been in the revision phase. Although he had started testing the resistance areas, nor the XRP/ETH graphs nor the XRP/BTC graphs had decidedly burst. “We could still be in this range to cut,” he warned. “It could lose strength until we start seeing some confirmations until the rise.”

At the time of printing, XRP was exchanged at $ 2.23.

First floor image created with Dall.e, graphic designer by tradingview.com