Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

Este Artículo También Está available en español.

XRP is facing a fundamental moment after having failed to test the level of resistance of $ 2.60, with an action of the prices that now supports the critical question. The token continues to exchange laterally in a wide range, reflecting the growing uncertainty while the largest cryptocurrency market must face a renewed sales pressure. Despite a strong performance in recent weeks, the bulls are struggling to maintain the momentum and the inability to push higher above has left vulnerable XRP to further consolidation or disadvantage.

Reading Reading

The overall feeling of the risk of the market is making it difficult for altcoin as XRP to establish a clear direction. Investors remain cautious and bulls must now defend the key support areas to avoid triggering a deeper correction. XRP is approaching an area of critical demand that could determine its short -term trajectory.

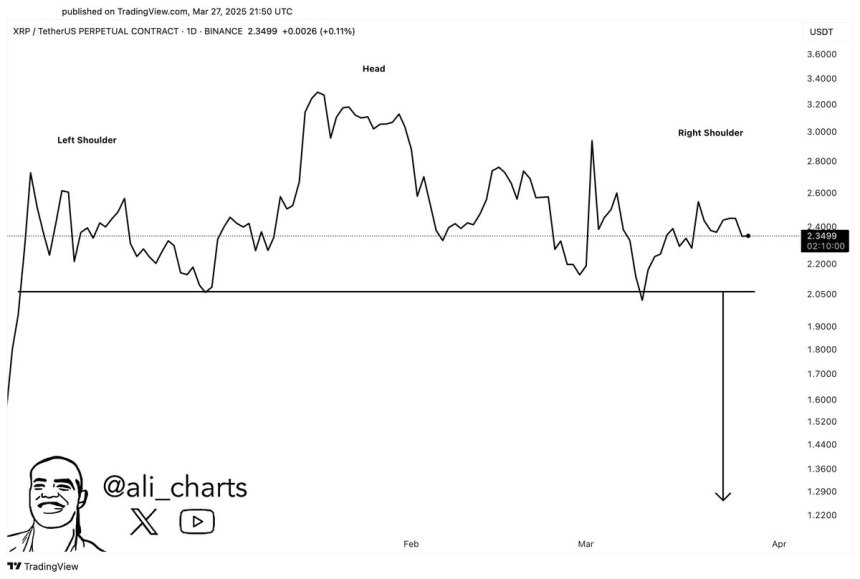

The cryptocurrency analyst, Ali Martinez, shared intuitions on X, indicating a potential bullish scenario if XRP can break above the sign of $ 3. According to Martinez, such a move would invalidate the current head and shoulders model that is formed on the graphic designer, effectively launching the perspectives in favor of the bulls.

XRP deals with the key to the rupture between the uncertainty of the market

XRP is approaching a critical point in its price structure, in which a breakout above the key levels could trigger a great trend. However, investors remain cautious, with many worried that the current configuration can be a trap for bulls, above all given the unstable macro environment. Since the end of January, the financial markets have had to face a growing turbulence, fueled by the fears of the commercial war and the irregular political behavior by the President of the United States Donald Trump. This uncertainty has strongly weighted the activities at risk, including cryptocurrencies, and continues to prevent a clear formation of trends throughout the line.

The action of XRP prices reflects this wider indecision of the market. While the token showed resilience, it remains blocked in a wide range, unable to build a prolonged bullish moment. The recent inability to break above the level of resistance of $ 2.60 added to the concern of investors, since the sales pressure seems to have returned to the market.

Martinez has plundered the situation, highlighting a technical level that could define the short -term trajectory of XRP. According to Martinez, if XRP can break above the sign of $ 3, invalidate the current head and shoulders model that forms on the graphic-one scheme typically associated with trendy inversions. This move would turn upside down the perspectives of the bullish market and open the doors for a great event.

Until that breakout occurs, however, the head and shoulders structure remains at stake and reduced risks cannot be ignored. Investors are observing closely while XRP exchanges near the levels of critical support and resistance, knowing that the next breakout or breaking could model its direction for the weeks to come. For now, XRP is captured in a narrow battle between the bearish pressure and the upper potential.

Reading Reading

Tori defend the key support at $ 2.20

XRP is currently exchanged at $ 2,22 after losing the critical level of $ 2.40, which aligns with the 4 -hour mobile average (mA) and the exponential mobile average (EMA). This failure has weakened the short -term momentum, putting bulls in a defensive position while the sales pressure begins to build. The level of $ 2.20 now stands as a key support area that must be defended to avoid a deeper correction.

To resume strength and move the momentum in favor of the bulls, XRP must recover the level of $ 2.35 in the next sessions. A move above this resistance area would indicate a renewed purchase interest and potentially activate a push towards the $ 2.60 interval. Until then, the action of prices remains fragile, with investors who look closely to confirmation.

Reading Reading

However, if XRP cannot contain $ 2.20, the market could see a strong drop in the sign of $ 2.00 – a level of psychological and structural support that has been held in previous corrections. This move would probably confirm the short -term bearish domain and further delay any potential breakout. While volatility continues to build, the next few hours could be crucial for the direction of the short -term tendency of XRP.

First floor image from Dall-E, TradingView chart