Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

The CEO of Coinroues, Dave Weisberger, detonated a new anxiety round on the XRP market on Monday when he asked, on Scott Melker’s podcast, if the Ripple laboratories could finance an acquisition of circles “for $ 10 to $ 20 billion” without the pomp of about $ 10 billion in XRP. “Who will buy $ 10 billion XRPs they need to sell from their treasure?” Weisberger said, warning that a sudden supply wave could overwhelm the books to order and “hammer the price”.

Is an XRP Sell-off conceively?

Within a few hours, the Pro-Xrp Fred Rispoli lawyer shot on X. “I Love @Daveweisberger1, but on this point McGlon is so strong,” he wrote, invoking the reputation of the Bloomberg strategist Mike McGlone for the hyperbole Bearish. “Only based on what is offered to me for my Ripple actions on the secondary market, I don’t think Ripple should even sell an XRP to buy Circle.” Rispoli has agreed that Ripple cannot collect $ 10 billion in pure liquidity, but insisted on the fact that the company could “easily afford the acquisition for a mix of cash and debts” and a heavy share swap.

Reading Reading

When Weisberger replied that Circle’s Board of Directors would probably have requested hard dollars unless he accepted Ripple Equity or XRP “Without haircut”, Rispoli dug. “No way to obtain $ 10 billion in cash-e $ 10 billion are still high”, citing the end of 2024 private research assessments that have put in $ 15 billion excluding its ~ 36 billion billion of Ecra Ecrag. If the Circle price fell to $ 7-9 billion, he said, Ripple could close with “$ 1-3 billion of cash at hand, a heavy bag and a debt”, in particular with “all that GCC money that slips into the Crypto world right now”. Rispoli admitted that it would have been “a scope” but “feasible without significantly selling XRP”.

Weisberger recognized mathematics-“This is a reasonable analysis”, he wrote, but he warned that any price at the higher end of the Rispoli range “could be a short-term pain for the owners of the United States XRP”.

Ripple’s income of offer offers in January 2024 evaluated the company at $ 11.3 billion, revealing more than $ 1 billion in cash and about $ 25 billion in digital activities-probely XRP-SUI His books. The company still controls about 52 billion XRP (about 40 percent of the offer), although 36 billion people find themselves in time -term reckles, limiting immediate access. At the price price of $ 2.20 today, the portion of expenditure is just under $ 35 billion, but also moving a fraction would quickly clash with a subtle depth of the place: a Weisberger point hammered at home.

Reading Reading

Ripple’s pile of cashier also reduced after its purchase of $ 1.25 billion of first Broker Hidden Roads in April, an agreement resolved a mixture of cash, actions and Stablecoins Rust. This acquisition suggests that society prefers hybrid structures, supporting Rispoli’s statement that the Treasury XRP does not have to flood the market.

Circle is also on sale?

The debate can be academic. Circle, USDC issuer, repeatedly declared him “not on sale” while marched towards a share of New York stock exchange that is now aimed at an evaluation of $ 7.2 billion. According to reports, Ripple’s approach, at the beginning of spring, passed $ 5 billion, well below the case of Weisberger’s stress and inside the “feasible” band of Rispoli, but Circle rejected the talks and updated his S-1 two weeks later, widening the float rather than looking for an buyer.

Strategically, Ripple is already putting its Rlust in the field which has been the dollar, launched in January and positioned by the president Monica, however “complementary to XRP, not a competitor”. The absorption of the USDC broadcaster would become instantly to the size of the bond.

Also under the optimistic structure of Rispoli, Ripple may still need to liquidate XRP for several hundred million dollars for the circulating capital and the closure of the costs. At current volumes, the unloading of only 500 million XRP (≈ $ 1.1 billion) would be equivalent to a week of global turnover, including distorting the price if not performed as private blocks.

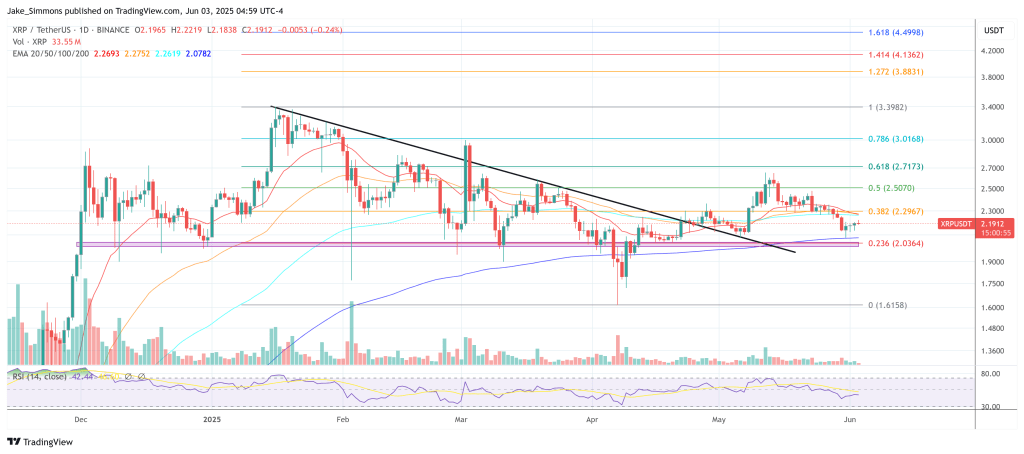

At the time of printing, XRP was exchanged at $ 2.19.

First floor image created with Dall.e, graphic designer by tradingview.com