Reason to trust

Editorial policy rejection that focuses on precision, relevance and impartiality

Created by experts in the sector and meticulously revised

The highest standards of reporting and publishing

Editorial policy rejection that focuses on precision, relevance and impartiality

Pretium leo et nisl alquam mollis measles. Quisque Arcu Lorem, ultricies quis pellesque nec, ullamcorper eu hate.

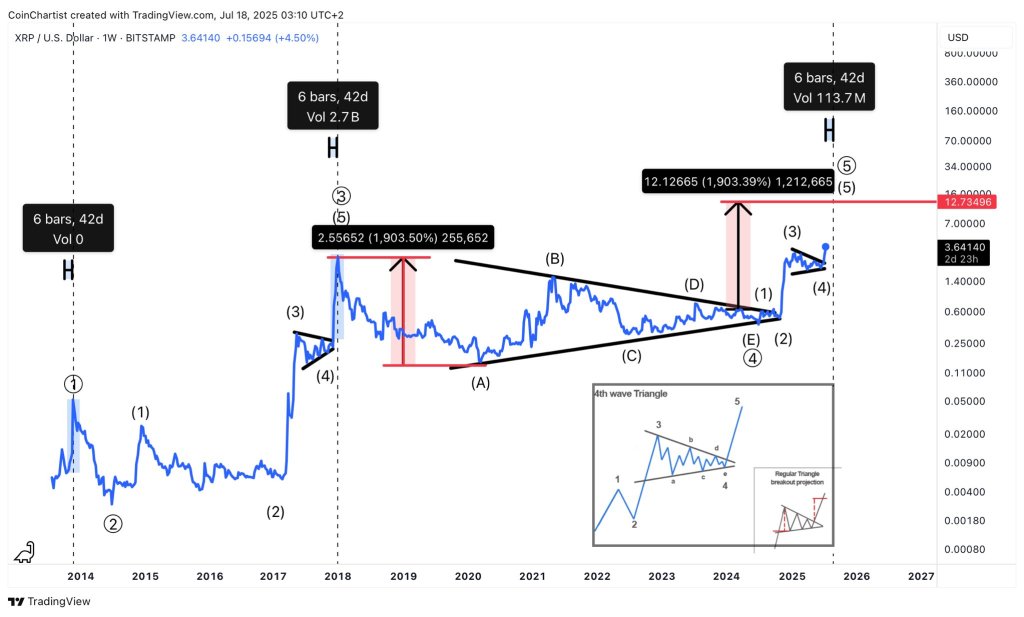

XRP has spent the best part of the last seven years to dig out of the crater left by the peak of 2018, yet the technician Tony “The Bull” Severino, CMT, now sees the possibility of a violent climax that would have rival – even the euphoric mirror of the 2017 cycle. By publishing in the X, the analyst asked the followers to contemplate “the final move in XRP – projected up to ~ $ 13 – Days “and provided the TradingView chart on a weekly scale.

$ 13 xrp just 40 days later?

The study is a construction of Elliott waves that labels the collapse of 2017 at the top as a terminus of the primary wave ③ and the subsequent trading interval of almost seven years as a contractual triangle of the fourth textbook. The action of prices from 2018 to the end of 2024 traces the familiar sequence A – B – C – and, with any oscillation delimited by black trend lines in constant competition that compress towards an apex of the end of 2024.

Reading Reading

Severino’s annotation draws particular attention to symmetry: the distance between the maximum 2017 and the low measures of 2018 $ 2.55, equal to 1.903.50 % from the pivot of four secondary waves, and took place in six weekly candles (42 days) with a volume of 2.7 billion XRP.

With the triangle now resolved to rise, the analyst counts the initial thrust as a wave (1) of the primary terminal ⑤ and Flags a small stenterer who develops as a wave (4) of the minor degree of the impulse.

A red vertical projection equal to the percentage ascent of 2017 -+1,903.39 % -was transposed by the post -striangolo base at approximately $ 0.64 (implicit in the height of $ 12 of the arrow) and ends at $ 12,73496, a level level at the level in Crimson through the right axis. The analogue of the time remains surprising: a dotted line, 42 days to the right of the current bar, bracket what would be the week six of the future wave, accompanied by a note of volume of placeholder of 113.7 million XRP.

Reading Reading

If the fractal report was valid – such as the insert of a “4th triangle” and “projection of breakouts of the regular triangle” implies – XRP should accelerate by about 250 % every week for the next six weeks to satisfy the vertical and temporal objectives at the same time

Severino’s follow -up comment suggests that this show would not obvious a subsequent bear cycle; Instead, it would complete the five -wave motivation structure and inaugurate the largest correction which for Elliott’s doctrine follows every complete impulse.

For the members, practical demand is not the philosophical admiration of the symmetry of the graphs, but if their positioning and risk framework can resist the volatility inherent in a move that, if made, would add almost $ 9 for money in just over a month.

At the time of printing, XRP was exchanged at $ 3.49

First floor image created with Dall.e, graphic designer by tradingview.com