According to recent reports, XRP has slipped by about 15% after reaching a peak of $ 3.66 on July 18, canceling about $ 2.4 billion in open future positions. That sharp drop has traders that discuss whether to break down or collect XRP near the sign of $ 2.60.

Rally led by great bets

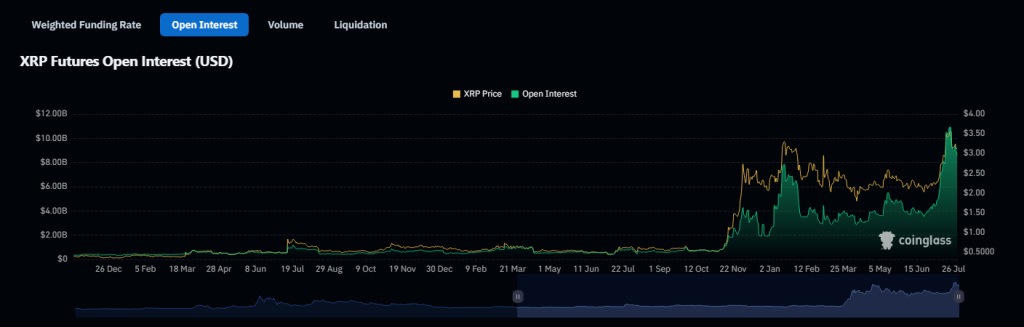

The wave of XRP from $ 2.17 on 1 July to $ 3.66 by 18 July was fed by a wave of open interests that reached the peak at $ 11.2 billion in terms of dollars. This means that many merchants had great positions around the second half.

Since then, the open interests have fallen to $ 8.8 billion, a 20% drop in value in US dollars. In the XRP units, contracts decreased by 10% to 2.80 billion. The liquidations of about $ 325 million in the two weeks ended on July 25 show that some of those large bets have been swept away.

Futures’ merchants are still

The annual future prizes for XRP monthly contracts remained in a 6% interval to 8%. This suggests that the traders are not panicking even after the price has fallen below $ 3.

The short -term swings did not trigger a rush in bullish bets when XRP has briefly climbed over $ 3.60, slowing down the risk of more forced outputs. Premium calm levels suggest that professional players remain cautious but not excessively worried.

Growing chat on an ETF US SPOT for XRP added to the mix. Ether Products has exceeded $ 18 billion of managed activities, so some expect a similar push if an ETF spot -XRP wins approval.

But the approvals can take many months and nothing is certain. Voices on banks or a link with Swift have sprung online without evidence. Traders know that the hype lasts only so long when there is no real deal.

The peers of activities on the Ledger

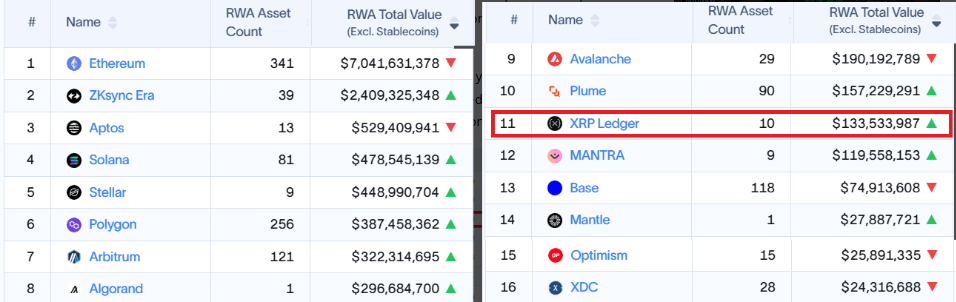

The use of Defi on the book Mastro XRP is still small. According to RWA.XYZ data, only $ 134 million tokenized activities sit on the net, compared to 190 million dollars on Avalanche.

The decentralized exchange volume barely produces the first 50 chains. Defillama shows that he recorded $ 13 billion in 30 -day trading dex and six managed $ 1.43 billion. Those gaps show that XRP on -chain tools did not attract the same crowd as rival networks.

Looking to the future, a clear growth of real use could help XRP to get out of its current $ 3.00– $ 3.15 range. For now, traders are looking at both prices and chain metric actions.

New catalysts could be needed beyond the hopes of the ETF to guide prolonged earnings. Until then, the market could remain rough and reactive to any large oscillation in open interest.

First floor image, Tradingview graphic designer